Loading

Get Il Co-1 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL CO-1 online

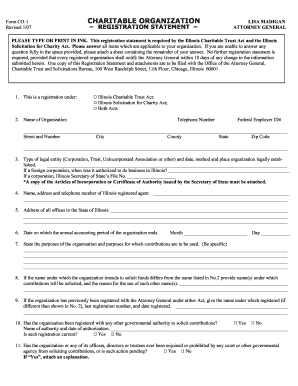

The IL CO-1 form is a registration statement required under the Illinois Charitable Trust Act and the Illinois Solicitation for Charity Act. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to fill out the IL CO-1 form online.

- Press the ‘Get Form’ button to access the registration form and open it in your browser.

- In section 1, select the applicable registration type by marking the appropriate box for the Illinois Charitable Trust Act, Illinois Solicitation for Charity Act, or both.

- Enter the name of your organization, including telephone number and Federal Employer ID number in section 2.

- Indicate the type of legal entity in section 3, providing the date, method, and place of your organization’s establishment.

- If your organization is a foreign corporation, include the date authorized to do business in Illinois.

- Provide the name, address, and telephone number of your Illinois registered agent in section 4.

- In section 5, list all office addresses in the State of Illinois.

- Complete section 6 by stating the end date of your organization's annual accounting period.

- In section 7, clearly describe the purposes of your organization and how contributions will be utilized.

- If different from section 2, provide any additional names under which contributions will be solicited and rationale in section 8.

- If previously registered, answer section 9 with the name under which registered, last registration number, and date registered.

- Indicate registration with other authorities in section 10, including the name and date of authorization.

- Answer section 11 concerning any court actions against your organization or its officers.

- In section 12, indicate if you plan to use a professional fund raiser and provide details if applicable.

- Section 13 requires disclosure of any legal issues involving your organization's officers or directors.

- State in section 14 who has final discretion over the distribution of contributions.

- Select the methods of solicitation your organization will use in section 15.

- Provide the chief executive or staff officer's information in section 16.

- Attach a list of all officers and directors in section 17.

- Answer section 18 about your organization’s tax-exempt status and attach the necessary documentation.

- If applicable, attach the required forms from section 20 and document the approximate contributions in section 21.

- Ensure that all necessary attachments are included as outlined in section 22.

- Once all fields are completed, review your entries for accuracy, then save your changes, and download or print the completed form.

Complete your IL CO-1 registration form online today to ensure compliance and support your organizational goals.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The Illinois Charitable Trust Act applies to organizations that hold property for a charitable purpose, such as nonprofit entities and charitable foundations. If your organization solicits donations or operates as a charity in Illinois, it falls under this act. Understanding the IL CO-1 requirements can help ensure your compliance with state regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.