Get Dfas 702 1997

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DFAS 702 online

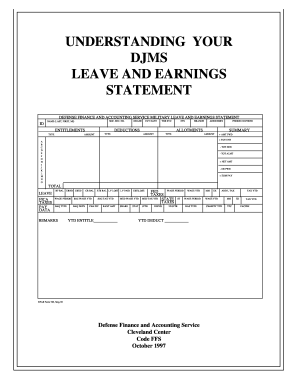

The DFAS 702 form is essential for understanding your military leave and earnings statement, detailing your entitlements, deductions, and allotments. This guide will provide you with clear instructions on how to accurately fill out the DFAS 702 online, ensuring you fully comprehend your financial information.

Follow the steps to complete the DFAS 702 form effectively

- Click the 'Get Form' button to obtain the DFAS 702 document and access it in the editor.

- Enter your name in the format of last name, first name, and middle initial in the designated field.

- Input your Social Security Number in the field provided.

- Select your current pay grade in the appropriate section.

- Fill in the pay date in YYMMDD format, indicating when you entered active duty for pay purposes.

- Indicate your years of creditable service in a two-digit format.

- Enter your Expiration Term of Service (ETS) in YYMMDD format.

- Specify your branch of service, such as Navy or Army.

- Input your Disbursing Station Symbol Number (ADSN/DSSN).

- Define the period covered by the LES, typically for one calendar month.

- Complete the entitlements section by listing any applicable payments and allowances.

- Detail the deductions, such as taxes and other contributions.

- Calculate the total of entitlements, deductions, and allotments in the summary section.

- Fill out the leave information, detailing balances earned, used, and lost.

- Provide federal tax information including earnings subject to withholding and exemptions.

- Include any state tax information as applicable.

- Conclude by completing fields for additional pay data and remarks.

- Once completed, review all entries for accuracy before saving your changes.

- Save, download, print, or share the form as needed.

Start completing your DFAS 702 form online today to ensure you understand your financial statement.

Get form

Related links form

YTD stands for Year-To-Date, and it represents the total amount accumulated from the beginning of the year to the present date. In the context of DFAS 702, YTD information is crucial for understanding your financial status and entitlements. By reviewing YTD figures, you can see how your earnings and deductions have changed throughout the year. This transparency helps you manage your finances more effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.