Loading

Get Caa Form 18.0 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CAA Form 18.0 online

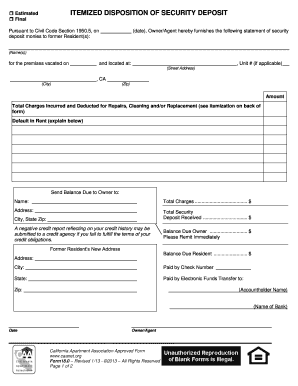

Filling out the CAA Form 18.0 online can help you efficiently manage the disposition of a security deposit. This guide provides clear step-by-step instructions for completing the form, ensuring you have all necessary information at your fingertips.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the estimated or final status of the security deposit by selecting the appropriate checkbox at the top of the form.

- In the section titled 'Deposit monies to former Resident(s)', fill in the former resident's name(s) and the date when the statement is being furnished.

- Provide the address of the premises vacated, including unit number if applicable, street address, city, and zip code.

- Detail the expenses by itemizing charges incurred and deducted for repairs, cleaning, and/or replacements. Refer to the back of the form for specific itemization guidelines.

- If applicable, explain any default in rent in the designated field below the charges section.

- Indicate the total security deposit received and the total charges, ensuring to subtract the charges from the total deposit to calculate the balance due.

- Fill in the name and address details of where to send the balance due, including the balance due to the owner and resident.

- Provide the check number or electronic funds transfer details, as needed, in the respective fields.

- Review all information for accuracy, ensuring all fields are filled out completely, then save changes, download, print, or share the completed form as necessary.

Complete your documents online today for a streamlined experience.

To renew your status as an IRS Certified Acceptance Agent, you must submit Form 13551 again, indicating any changes from your previous application. It's essential to complete this renewal before your current certification expires to continue offering services related to CAA Form 18.0. Keeping your training and certification up-to-date will enhance your credibility with clients.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.