Loading

Get Nat14363 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NAT14363 online

Filling out the NAT14363 form correctly is essential for ensuring your tax obligations are met. This guide will provide you with clear, step-by-step instructions on how to complete the form online, helping you navigate each section with confidence.

Follow the steps to accurately complete the NAT14363 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

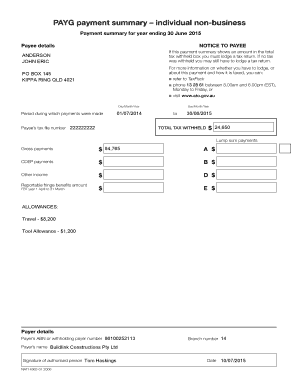

- Enter the payee details at the top of the form. This section requires the name, which should match the individual's legal name as well as their tax file number. Ensure the information is accurate to avoid complications with the tax office.

- In the period during which payments were made, clearly indicate the start and end dates. This should reflect from 01/07/2014 to 30/06/2015, according to the provided example.

- Fill out the total tax withheld box. If there was an amount shown, ensure it corresponds with the records; in this case, it is $24,650.

- Complete the gross payments section, entering the total gross payments made, which in this document equates to $84,765.

- If applicable, fill in any lump sum payments, CDEP payments, and other income amounts accordingly. Ensure any allowances, such as travel or tool allowances, are also recorded.

- Next, you will need to fill out the payer's details, including the payer's Australian Business Number (ABN) and business name. This information verifies the entity that made the payments.

- Lastly, ensure the signature of the authorized person is included, along with the date when the payment summary is finalized.

- Once all fields are completed, review your entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Start completing your NAT14363 form online today to stay compliant with your tax obligations.

To fill out a withholding exemption form, begin with your personal information, such as your name and address. Then, indicate your eligibility for exemption by providing any necessary supporting details. Accuracy is crucial, so ensure all information is complete and correct before submitting. For confidence in your form, refer to NAT14363 for helpful information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.