Loading

Get Non Resident Alien Nra Certification Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non Resident Alien NRA Certification Statement online

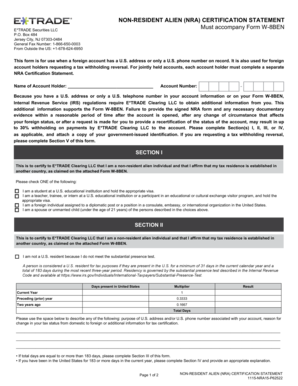

The Non Resident Alien NRA Certification Statement is a crucial document for individuals with foreign tax residency. This guide provides step-by-step instructions on how to complete this form online, ensuring that you provide all necessary information accurately.

Follow the steps to complete the Non Resident Alien NRA Certification Statement online.

- Click ‘Get Form’ button to access the Non Resident Alien NRA Certification Statement and open it in your preferred online editor.

- Begin by filling in your name and account number in the designated fields at the top of the form.

- Proceed to Section I. Select one of the provided options that best describes your status, confirming that you are a non-resident alien individual.

- If you do not meet the substantial presence test, move to Section II and affirm your status as a non-resident alien by explaining your presence in the U.S. and your tax residency.

- If you meet the substantial presence test, complete Section III by explaining why you maintain your foreign residency despite meeting the test.

- For those present in the U.S. for 183 or more days in the current year, Section IV must be fully completed, confirming your non-resident status and your country of residence.

- If you are requesting a tax withholding reversal, complete Section V by certifying your foreign tax residency with the appropriate date.

- Finally, review all your responses for accuracy. Once confirmed, sign and date the certification at the end of the form.

- You can now save your changes, download the completed form, print it, or share it as necessary.

Complete your Non Resident Alien NRA Certification Statement online today to ensure accurate processing of your tax status.

An alien is any individual who is not a U.S. citizen or U.S. national. A nonresident alien is an alien who has not passed the green card test or the substantial presence test.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.