Loading

Get Lansing Mi Form L941

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lansing Mi Form L941 online

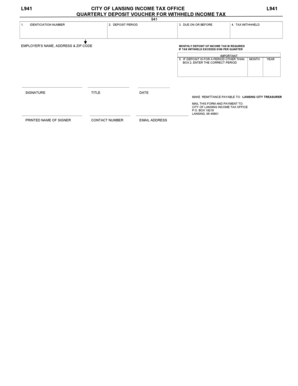

Filling out the Lansing Mi Form L941 is essential for employers who need to report withheld income tax. This guide provides clear instructions to assist users in completing the form online accurately and efficiently.

Follow the steps to fill out the Lansing Mi Form L941 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identification number in the designated field. This number is crucial for correctly identifying your tax records.

- In the 'Deposit Period' section, specify the quarter for which you are reporting the withheld taxes. Ensure you choose the correct period to avoid complications.

- Fill in the 'Due on or before' date, indicating the deadline for tax submission to facilitate timely deposits.

- Provide your employer’s name, address, and ZIP code in the appropriate fields, ensuring that all information is accurate and up-to-date.

- Indicate the total amount of tax withheld in the 'Tax Withheld' section. This figure must reflect the accurate total for the reporting period.

- If your deposit is for a period different from the one indicated in step 2, enter the correct period in the designated box.

- Sign the form in the signatures area; include your printed name, title, and date to validate the document. Also, provide your contact number and email address for any follow-up communication.

- After completing the form, review all entries for accuracy. You can then choose to save changes, download the form, print it, or share it as necessary.

Complete the Lansing Mi Form L941 online today to ensure compliance with tax regulations.

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.