Get Canada Gst62 E 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Canada GST62 E online

How to fill out and sign Canada GST62 E online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience all the benefits of completing and submitting documents online.

Utilizing our service to fill in the Canada GST62 E form will take just a few minutes. We enable this by providing you with access to our robust editor capable of altering/correcting the document's original text, adding unique fields, and affixing your signature.

Submit the new Canada GST62 E digitally once you have completed it. Your data is securely protected, as we adhere to the latest security protocols. Join many happy customers who are already filling out legal forms from the comfort of their homes.

- Locate the document template you need from the legal forms library.

- Select the Get form button to access the document and commence editing.

- Complete the necessary fields (highlighted in yellow).

- The Signature Wizard will allow you to insert your electronic signature once you have filled in the information.

- Enter the date.

- Review the entire document to confirm you have finished everything and no revisions are necessary.

- Click Done and download the completed template to your device.

How to modify Get Canada GST62 E 2011: personalize forms digitally

Utilize our extensive online document editor while finalizing your documentation.

Complete the Get Canada GST62 E 2011, highlight the most important details, and seamlessly make any other necessary modifications to its content.

Filling out forms electronically saves time and allows you to tailor the template to your specifications. If you plan to handle the Get Canada GST62 E 2011, consider filling it out with our diverse online editing tools. Whether you make a mistake or input the required information in an incorrect field, you can swiftly amend the document without starting over as you would with a manual fill-in. Additionally, you can emphasize the essential data in your document by coloring specific parts of the content, underlining them, or encircling them.

Our robust online tools are the most efficient method to finalize and adapt Get Canada GST62 E 2011 per your requirements. Use it to manage personal or business documentation from anywhere. Open it in a browser, make changes to your documents, and revisit them at any time in the future - all will be securely stored in the cloud.

- Launch the file in the editor.

- Input the necessary information in the empty spaces using Text, Check, and Cross tools.

- Follow the document's navigation to ensure all mandatory fields are filled in.

- Encircle some of the key details and include a URL to it if needed.

- Utilize the Highlight or Line options to emphasize the most pertinent facts.

- Select colors and thickness for these lines to enhance your sample's professional appearance.

- Remove or obscure the information you don't wish to share with others.

- Substitute segments containing errors and enter the required text.

- Conclude editing with the Done button after ensuring everything in the document is accurate.

Related links form

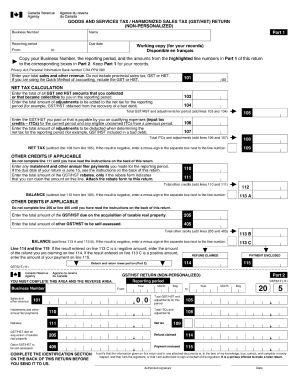

Filling out GST details requires gathering your business revenue information and the total GST collected. Use the Canada GST62 E form to document this information properly. Make sure to follow the instructions clearly, as providing accurate details will enhance the efficiency of your filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.