Loading

Get Canada Gst62 E 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST62 E online

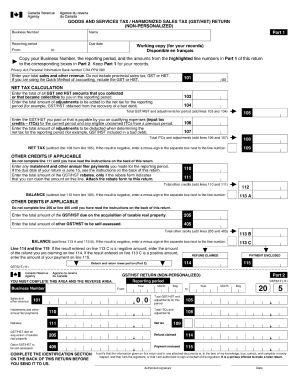

Filling out the Canada GST62 E form online can streamline your tax reporting process. This guide provides a clear, step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your business number in the designated field. This is essential for identifying your GST account.

- Next, provide the period covered by your GST return, ensuring you indicate the correct dates. This information helps in processing your return accurately.

- Complete the sales information section by detailing your total sales, including both taxable and exempt sales. Make sure to separate these amounts clearly.

- In the input tax credits section, list the amounts you've claimed for GST/HST paid on purchases related to your business. This field is critical for determining your refund or amount owed.

- Review any pre-filled data for accuracy and make necessary adjustments. Double-checking your information can prevent errors.

- Once all relevant fields are filled out correctly, save your changes. Utilize the option to download, print, or share the completed form, ensuring you retain a copy for your records.

Start completing your GST62 E form online today for a smoother filing experience.

Related links form

Filling out GST details requires gathering your business revenue information and the total GST collected. Use the Canada GST62 E form to document this information properly. Make sure to follow the instructions clearly, as providing accurate details will enhance the efficiency of your filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.