Get Az De-102 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ DE-102 online

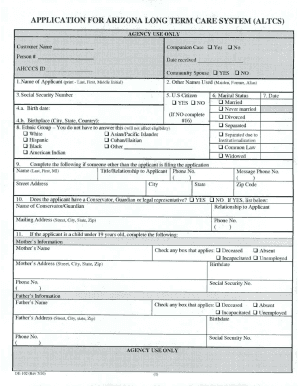

The AZ DE-102 form is essential for applying to the Arizona Long Term Care System (ALTCS). This guide will provide you with a clear, step-by-step approach to filling out the form online, ensuring you understand each component and complete the application accurately.

Follow the steps to complete the AZ DE-102 form online.

- Press the ‘Get Form’ button to access the form and open it for filling out online.

- Begin by entering the name of the applicant in the appropriate fields, ensuring to include last name, first name, and middle initial. If there are any other names used by the applicant (like maiden or former names), please provide that information.

- Input the applicant's Social Security number in the designated space.

- Indicate whether the applicant is a U.S. citizen by selecting 'Yes' or 'No'.

- Provide the applicant's birth date and birthplace including the city, state, and country.

- For ethnic group information, you may choose to disclose this but understand it is not mandatory and will not impact eligibility.

- Select the marital status from the options provided such as married, never married, separated, etc.

- If applicable, include details about a conservator, guardian, or legal representative by filling in their name, mailing address, and relationship to the applicant.

- Complete the section for individuals other than the applicant who may be filing this application on their behalf, indicating their relationship and contact information.

- If the applicant is under 19 years old, include the mother’s and father’s information, including their names, addresses, and social security numbers.

- Describe the current living arrangement by indicating whether the applicant lives at home, in a nursing home, in a hospital, or has in-home services.

- Continue through sections 18 to 36, answering questions about income, assets, resources, and expenses, as well as any medical coverage information.

- Ensure you read all sections thoroughly and answer every question accurately, as incomplete forms may delay processing.

- Finally, sign and date the application, ensuring any representative or witness signatures are included as necessary before submitting.

- Once you have filled out the form, you can save changes, download, print, or share the completed AZ DE-102 as needed.

Complete your application for ALTCS online today to ensure you receive the benefits you need.

Related links form

You can find Arizona tax forms, including the AZ DE-102, online at the Arizona Department of Revenue's website. They offer all necessary forms for download or print. Additionally, local tax offices and community centers often have physical copies available if you prefer to pick them up in person. Utilizing platforms like USLegalForms also simplifies the process of finding and completing these documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.