Get Ca A-1-131 1980

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA A-1-131 online

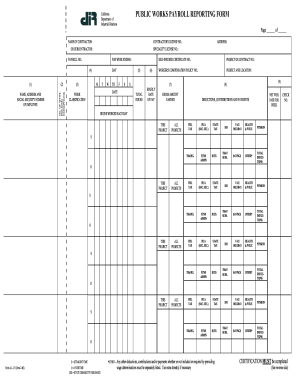

The CA A-1-131 form is an essential document used for reporting payroll information in compliance with California's labor laws. This guide provides a clear, step-by-step approach to help you accurately complete this form online, ensuring all required details are captured correctly.

Follow the steps to effectively complete the CA A-1-131 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the contractor or subcontractor at the appropriate section. This identifies who the payroll report is for.

- Provide the contractor's license number and the payroll number for the current reporting period. This ensures clarity and accountability.

- Mark the week ending date clearly. This date is crucial for understanding the reporting timeframe.

- List the name, address, and Social Security number of each employee. Make sure to spell names correctly and input accurate details for proper recordkeeping.

- Indicate the number of withholding exemptions for each employee. This affects tax calculations and must be filled out carefully.

- Record the work classification for each employee. This helps categorize the type of work performed during the reporting period.

- Fill in the total hours worked by each employee throughout the week. Pay attention to separate entries for regular and overtime hours.

- Insert the hourly rate of pay for each employee to determine the gross earnings accurately.

- List the project or contract number, as well as the location of the work performed. This provides context for the payroll report.

- Detail all deductions, such as federal tax, state tax, and any contributions or payments for benefits. Ensure totals are calculated accurately.

- Review and verify all information entered for completeness and accuracy before proceeding.

- At the end of the process, you can save changes, download, print, or share the completed form to fulfill filing requirements.

Start filling out your CA A-1-131 form online today to ensure compliance with payroll reporting requirements.

Get form

In California, certain small projects may be exempt from some public works requirements, including bidding, prevailing wage, and DIR registration. Specifically, projects costing under a set dollar threshold may qualify for this exemption. However, even small projects must still comply with basic state regulations. Being aware of the CA A-1-131 exemptions can help contractors decide how to approach these smaller projects.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.