Loading

Get E-z Switch - Blackhawkbankcom

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E-Z Switch - Blackhawkbankcom online

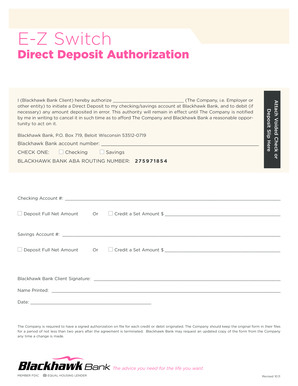

Filling out the E-Z Switch - Blackhawkbankcom form is an essential step for setting up direct deposit with Blackhawk Bank. This guide will walk you through the process of completing the form online, ensuring all necessary information is accurately submitted.

Follow the steps to successfully complete the E-Z Switch form.

- Click the ‘Get Form’ button to access the E-Z Switch form in your preferred editor.

- Start by entering your Blackhawk Bank account number in the designated field. Ensure this number is accurate to facilitate correct deposits.

- Select whether you prefer to designate a checking or savings account by marking the appropriate option.

- Attach a voided check or a deposit slip as instructed. This helps verify your account information.

- In the designated section, authorize the specific company or entity that will initiate the direct deposit. Enter the name of your employer or the applicable organization.

- Fill in the Blackhawk Bank ABA routing number: 275971854, making sure to enter this information correctly.

- Decide how you want your funds to be deposited. Choose either 'Deposit Full Net Amount' or 'Credit a Set Amount' and specify the amount if applicable.

- If applicable, repeat the previous step for your savings account as well, filling out the required fields.

- Provide your signature in the space designated for the Blackhawk Bank client signature.

- Print your name in the 'Name Printed' field and enter the date of signing.

- Review all the information for accuracy before proceeding to save any changes made to the form. You can then download, print, or share the completed form as needed.

Complete your documents online today and set up your direct deposit with ease.

Bank of America Advantage Plus has a $100 minimum opening deposit and a $12 monthly maintenance fee which can be waived if you do one of the following: Make at least one qualifying Direct Deposit of $250 or more. Maintain a minimum daily balance of $1,500 or more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.