Loading

Get Vat 350

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 350 online

Filling out the Vat 350 form online is essential for managing your tax obligations effectively. This guide will provide you with clear, step-by-step instructions to simplify the process and ensure you complete the form accurately.

Follow the steps to complete the Vat 350 form online.

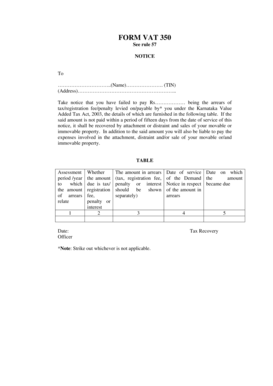

- Press the ‘Get Form’ button to access the Vat 350 form and open it in your preferred editor.

- Enter your name in the designated field. This is the person responsible for the tax or registration fee.

- Input your Tax Identification Number (TIN) in the appropriate box to ensure proper identification.

- Fill in your full address accurately. This helps in sending any further communications regarding your tax status.

- In the table provided, indicate the assessment period or year related to the amount in arrears by entering the appropriate details in the first column.

- Specify whether the amount due is for tax, registration fee, penalty, or interest in the second column of the table.

- Clearly display the amount in arrears in the third column, ensuring to break it down into tax, registration fee, penalty, or interest where applicable.

- Fill in the date of service of this notice, which is the date you provide this form to the relevant authority.

- Record the date on which the amount of demand notice became due in the specified field.

- Review all entered information for accuracy before proceeding to save your changes.

- Once you are satisfied with the content, you can download, print, or share the completed form as required.

Take action now and complete your Vat 350 form online to stay compliant with your tax obligations.

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government - the same way that Value Added Tax (VAT) is paid in many countries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.