Loading

Get Ms Sales Tax Forms Printable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ms Sales Tax Forms Printable online

Filling out the Ms Sales Tax Forms Printable can be a straightforward process with the right guidance. This guide aims to provide you with comprehensive instructions on how to complete the form accurately and efficiently, ensuring your compliance with state tax regulations.

Follow the steps to complete your Ms Sales Tax Forms Printable online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

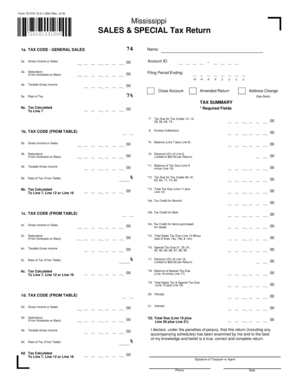

- Begin by entering your name, account ID, and the filing period ending date in the appropriate fields at the top of the form.

- In section 1a, select the tax code that applies to your business. If you are unsure, refer to the Tax Category Table included in the form for guidance.

- Move to the ‘Gross Income or Sales’ field (2a) and enter your total sales amount for the filing period.

- Calculate your taxable gross income in section 4a by subtracting your deductions (3a) from your gross income (2a).

- Input the applicable tax rate in section 5a based on your business type as identified in the Tax Category Table.

- In section 6a, compute the tax calculated for the tax due by multiplying the taxable gross income (4a) by the rate of tax (5a).

- Proceed to the summary section to calculate your total tax due. Follow the instructions for each line carefully, including adding any excess collections and subtracting any vendor discounts applicable.

- Review all entries for accuracy. Once confirmed, save the document, and consider downloading or printing a copy for your records.

- Remember to sign the form and include your contact information before submission.

Complete your Ms Sales Tax Forms Printable online today to ensure your compliance with state tax laws.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item. The tax is based on gross proceeds of sales or gross income, depending on the type of business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.