Loading

Get Uk Hmrc Form P45 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC Form P45 online

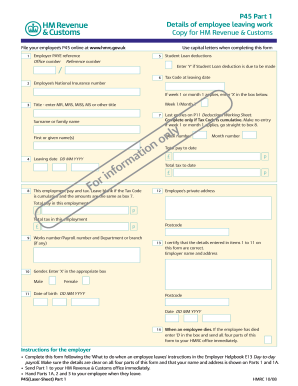

Filling out the UK HMRC Form P45 online is an important task for anyone leaving employment. This form provides essential information regarding your employment and tax status, which is necessary for continuity in your financial affairs.

Follow the steps to complete the online P45 form successfully.

- Press the ‘Get Form’ button to access the online form and display it in the editor.

- Enter the employer PAYE reference in the designated field. Ensure it is accurate to avoid complications.

- Provide the employee's personal information, including their title, surname, first name, and National Insurance number.

- Input the leaving date in the format DD MM YYYY. Double-check that this date is correct.

- Fill in the employee's total pay to date and the total tax to date. Verify these amounts from the payroll records.

- If applicable, enter the tax code at the leaving date. If the week 1 or month 1 tax code applies, mark the appropriate box.

- Indicate if student loan deductions should be made by entering 'Y' if applicable.

- Confirm all details entered are correct by certifying the information as specified in the form.

- Once all fields are completed, review the information for accuracy. Correct any errors if necessary.

- Finalize the process by saving changes, and choose to download, print, or share the completed form as needed.

Complete the form online today to ensure a smooth transition in your employment process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Typically, you should receive your UK HMRC Form P45 shortly after leaving your job. Employers are required to provide it on your last working day, or shortly thereafter. If you haven't received it within a few weeks, follow up with your employer to check the status. This ensures that your tax records remain updated.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.