Loading

Get Ar1100ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1100ct online

This guide will provide you with step-by-step instructions on how to effectively fill out the Ar1100ct online form. Whether you are a first-time filer or need a refresher, this comprehensive guide ensures you complete the form accurately and efficiently.

Follow the steps to complete the Ar1100ct online.

- Click ‘Get Form’ button to obtain the Ar1100ct and open it in your preferred editing platform.

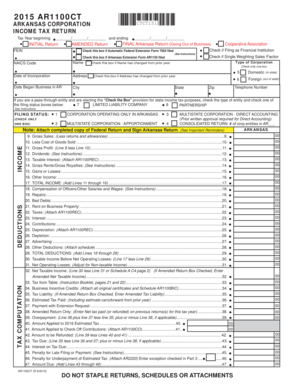

- Enter your tax year at the beginning and ending dates. Be sure to select whether this is an amended or initial return, and check if this is your final Arkansas return if applicable.

- Input your Federal Employer Identification Number (FEIN) and ensure your corporation name is clearly indicated.

- Fill in your NAICS code, check if you are a cooperative association, and indicate if you are filing as a financial institution.

- Provide your date of incorporation, business start date in Arkansas, and the business address, including city, state, and zip code.

- Select the type of corporation you are filing for and check any applicable boxes, including those for address or name changes from prior years.

- Indicate your filing status (e.g., corporation operating only in Arkansas, multistate corporation, etc.) and fill out the appropriate boxes.

- Complete the tax computation section by entering your income details, deductions, and other relevant financial information as specified on the form.

- Ensure to attach any required documents, such as a completed copy of the federal return, and any schedules pertaining to deductions or income.

- Finally, review the completed form thoroughly, save your changes. You can then download, print, or share the document as required.

Proceed to complete your Ar1100ct online to ensure accurate tax filing.

Purpose. Use Form 100-ES to figure and pay estimated tax for a corporation. Estimated tax is the amount of tax the corporation expects to owe for the taxable year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.