Loading

Get Au Nat 3092 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 3092 online

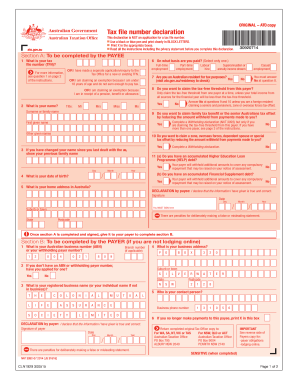

The AU NAT 3092 form is a crucial declaration for individuals to provide their tax file number and relevant details to their payer. This guide will assist you in completing the form online with clear and concise instructions tailored to your needs.

Follow the steps to complete the AU NAT 3092 form online:

- Press the ‘Get Form’ button to access the AU NAT 3092 form and open it in the relevant editor.

- In Section A, provide your tax file number (TFN) in the designated field. If you do not yet have a TFN, indicate that you have made a separate application to the Tax Office.

- Enter your full name, including surname and given names, in the appropriate fields.

- Indicate your payment basis by selecting one of the options such as full-time employment, part-time employment, or other applicable categories.

- State whether you are an Australian resident for tax purposes by selecting 'Yes' or 'No'. If 'No', be aware that you need to complete further applicable questions accordingly.

- If applicable, answer whether you wish to claim the tax-free threshold from this payer by selecting 'Yes' or 'No'. Remember, only claim the tax-free threshold from one payer at a time.

- Indicate if you want to claim tax offsets like the family tax benefit or senior Australians tax offset that may affect withholding amounts.

- If you have any accumulated debts from programs like HELP or Financial Supplement, provide information accordingly.

- Complete your date of birth and home address in Australia accurately.

- Sign the declaration to confirm the truthfulness of the information provided and enter the date of signing.

- Once Section A is completed, submit it to your payer for them to fill out Section B, following your signature.

- After the payer completes their section, you can save the form, download, print, or share it as required.

Complete your AU NAT 3092 form online today to ensure accurate tax processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filling out a withholding allowance certificate, including the AU NAT 3092, ensure you provide accurate personal information and detail your exemptions. Carefully follow the instructions to ensure you correctly determine how much tax should be withheld from your paycheck. This small yet significant step can lead to better tax planning.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.