Loading

Get Deed Of Priority

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deed Of Priority online

Filling out the Deed Of Priority online can be a straightforward process with the right guidance. This document is essential for outlining the priorities of lenders when multiple mortgages are involved, ensuring clarity for all parties.

Follow the steps to complete the Deed Of Priority accurately.

- Click the ‘Get Form’ button to access the Deed Of Priority document. This will allow you to open the form in an online editor for completion.

- Enter the date at the top of the form. This marks when the Deed Of Priority is being executed and is essential for record-keeping.

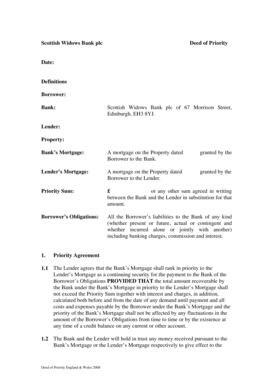

- In the definitions section, fill in the necessary information for the Borrower and the Bank. The Borrower is the party taking the loan, while the Bank refers to Scottish Widows Bank plc located at 67 Morrison Street, Edinburgh, EH3 8YJ.

- Complete the Lender and Property sections. The Lender is the party providing the mortgage, and the Property refers to the asset associated with the mortgages in question.

- Specify the Priority Sum, which is the total amount recoverable by the Bank under the Bank's Mortgage priority. Ensure that this matches any agreements in writing between the Bank and the Lender.

- Review the Borrower’s Obligations section to ensure all liabilities owed to the Bank are accurately reflected. This should include any banking charges and interests that may apply.

- Read through the Priority Agreement provisions carefully to understand how the priorities are established between the Bank's Mortgage and Lender's Mortgage.

- Check the Governing Law section to note that English law will apply to this deed, ensuring compliance with local legal standards.

- In the interpretation section, confirm that the definitions of Bank and Lender encompass their respective successors and assigns, which may be important for clarity.

- Finally, have the document executed with the necessary signatures from authorised signatories for both the Lender and the Scottish Widows Bank plc before finalizing your document.

- Once completed, you can save your changes, download the document, print it, or share it as needed.

Complete your Deed Of Priority online today to ensure clear understanding and compliance among all parties involved.

Waiver of Priority means (i) in the case of premises leased by the Issuer or a Restricted Subsidiary, a written consent or agreement from the landlord of such premises to the Lien in such lease and in the inventory located at such premises held by the Collateral Trustee and to the Collateral Trustee having access to ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.