Loading

Get Or 735-32 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 735-32 online

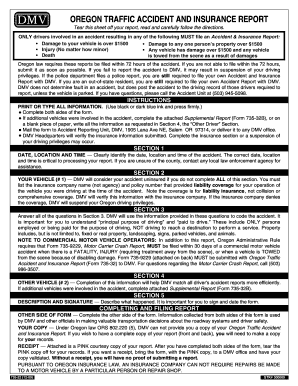

Filling out the OR 735-32 form, also known as the Oregon Traffic Accident and Insurance Report, is an essential step for individuals involved in an accident meeting specific criteria. This guide aims to assist users in navigating the form accurately and efficiently in an online environment.

Follow the steps to complete the OR 735-32 form online.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Begin with Section 1, providing the date, location, and time of the accident. Ensure that this information is accurate, as it is crucial for processing your report.

- In Section 2, complete all fields related to your vehicle, including your name, driver's license number, vehicle owner information, and insurance company details. It is mandatory to fill in the insurance company name accurately to avoid potential suspension of driving privileges.

- Proceed to Section 3, responding to the checklist regarding the nature of the accident and circumstances. This helps DMV categorize the incident appropriately.

- Move to Section 4, where you will provide information regarding any other vehicles involved. If there are additional vehicles, direct users to complete the attached Supplemental Report (Form 735-32B) or write the necessary details on a separate sheet.

- In Section 5, describe the accident. Be as detailed as possible about what occurred and ensure to sign and date the form at the end.

- Complete the reverse side of the form before finalizing. This side contains essential information that ties into the overall reporting purpose.

- Once all sections are filled out, users can save changes, download, print, or share the completed form as needed.

Complete your OR 735-32 form online today to ensure compliance and smooth processing of your report.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing taxes for someone who is deceased can involve preparing their final income return using their income data for the year. It is essential to indicate their status correctly on the form. Familiarizing yourself with OR 735-32 ensures that you cover all necessary tax obligations appropriately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.