Loading

Get State Of Rhode Island And Providence Plantations Form Ars-d - Tax Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Rhode Island And Providence Plantations Form ARS-D - Tax Ri online

Filling out the State Of Rhode Island And Providence Plantations Form ARS-D - Tax Ri online is essential for accurately reporting rental vehicle surcharges. This guide provides step-by-step instructions to ensure a smooth and efficient completion of the form.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

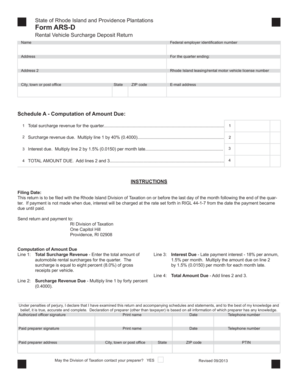

- Enter your name and federal employer identification number in the designated fields.

- Provide your complete address including address 2, city, town or post office, state, and ZIP code.

- Enter your Rhode Island leasing/rental motor vehicle license number.

- Indicate the quarter for which you are filing.

- In Schedule A, calculate the total surcharge revenue for the quarter. Enter this value on line 1.

- Calculate the surcharge revenue due by multiplying the total surcharge revenue on line 1 by 40% (0.4000) and enter the result on line 2.

- If applicable, calculate any interest due for late payments by multiplying the amount on line 2 by 1.5% (0.0150) per month for each month late, and enter this on line 3.

- Add the amounts on lines 2 and 3 to find the total amount due; record this sum on line 4.

- Complete the declaration at the bottom of the form, ensuring you have an authorized officer signature, printed name, date of signing, and telephone number.

- If using a paid preparer, complete their information as required, including their signature, address, and whether the Division of Taxation can contact them.

- Review all entries to confirm accuracy, then save your changes. You can download, print, or share the completed form as needed.

Ensure your rental vehicle surcharge is filed accurately; complete your forms online today.

That's because seven US states don't impose state income tax Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. New Hampshire and Tennessee don't tax earned income either, but they do tax investment income in the form of interest and dividends at 5% and 1%, respectively, for the 2020 tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.