Loading

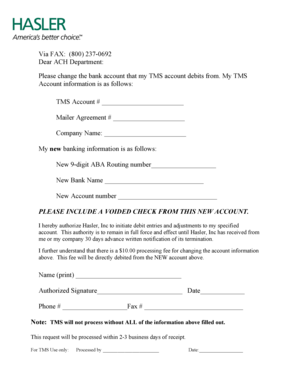

Get Via Fax 800 237-0692 Dear Ach Department Tms Account

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Via FAX 800 237-0692 Dear ACH Department TMS Account online

Filling out the Via FAX 800 237-0692 Dear ACH Department TMS Account form is essential for updating your bank account information for debit transactions. This guide will provide clear and concise instructions on how to complete each section of the form online.

Follow the steps to complete the form efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your TMS Account number in the designated space. This number is crucial for identifying your account.

- Fill in your Mailer Agreement number. This information helps in verifying your request.

- Next, provide your Company Name. Ensure that it matches the name associated with your TMS Account.

- Input your new 9-digit ABA Routing number. This number is essential for ensuring accurate routing of funds.

- Enter the name of your new bank in the respective field. Double-check for any spelling errors.

- Fill in your new account number. This is the account where future debits will be directed.

- Attach a voided check from the new account. This serves as verification for the banking details you have provided.

- Authorize Hasler, Inc. by signing in the designated field. Include the date of your signature.

- Finally, provide your phone number and fax number in the specified areas.

- Once all fields are filled out correctly, save your changes, and proceed to download or print the form for submission.

Complete your documents online to ensure accurate processing of your bank account information change.

Foreign exchange gains and losses are taxable and deductible respectively if the gains and losses are: arising from revenue transactions; realised; arising from a trade.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.