Loading

Get 62a366 12-12 Date Order Correcting Department Of Revenue - Revenue Ky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 62A366 12-12 Date ORDER CORRECTING DEPARTMENT OF REVENUE - Revenue Ky online

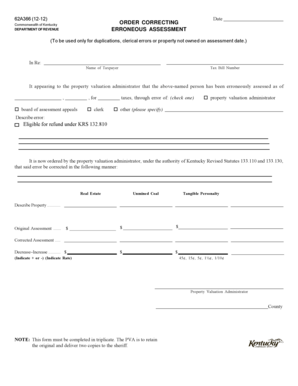

Filling out the 62A366 12-12 Date ORDER CORRECTING DEPARTMENT OF REVENUE form is an essential step for addressing erroneous property assessments in Kentucky. This guide provides clear, step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to effectively fill out your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Name of Taxpayer' section, enter the full name of the individual or entity for whom the correction is being requested. Ensure that the name is spelled correctly, as this will be crucial for identification purposes.

- Next, find the 'Tax Bill Number' field and input the relevant tax bill number associated with the erroneous assessment. This information links the correction request to the specific assessment.

- Indicate the date the erroneous assessment was made by filling in the appropriate date. This ensures that the correction is recorded accurately.

- Select the appropriate reason for the erroneous assessment by checking one of the boxes labeled 'board of assessment appeals' or 'clerk'. This helps categorize the type of error being addressed.

- Identify the source of the error by selecting either 'property valuation administrator' or 'other', and if you choose 'other', provide a brief explanation in the 'Describe error' section.

- If applicable, indicate if you are eligible for a refund under KRS 132.810 by marking the corresponding box.

- In the section detailing the correction, specify the nature of the property (Real Estate, Unmined Coal, Tangible Personalty) that is subject to the assessment correction by selecting the relevant type.

- Fill in the 'Original Assessment' amount for each property type you are correcting, followed by the 'Corrected Assessment' amount. Clearly indicate any decrease or increase in the assessment by noting whether it is a + or - adjustment.

- Provide the appropriate assessment rate in the designated area (e.g., 45¢, 15¢). This information supports the calculation of taxes owed post-correction.

- Enter the name of the Property Valuation Administrator in the designated field to ensure accountability.

- Review all entries for accuracy, save your changes, and proceed to download, print, or share the completed form as necessary. Remember that this form must be completed in triplicate; the original remains with the Property Valuation Administrator, while the two copies should be delivered to the sheriff.

Complete your document online today to correct your property assessment efficiently.

To obtain a previous year(s) refund status, please call (502) 564-4581 to speak to an examiner. Prior year and amended return processing may require in excess of 20 weeks to complete.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.