Loading

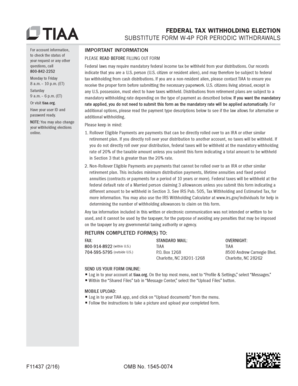

Get Federal Tax Withholding Election Substitute Bformb W-4p For Bb - Tiaa-cref

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Federal Tax Withholding Election Substitute Form W-4P for TIAA-CREF online

Filling out the Federal Tax Withholding Election Substitute Form W-4P online is an essential step for users receiving periodic withdrawals from TIAA-CREF accounts. This guide provides a clear and structured approach to help ensure that all necessary information is accurately completed.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred online platform.

- Provide your information in Section 1. Fill in your first name, middle initial, last name, suffix, and Social Security Number or Taxpayer Identification Number. Ensure you clearly indicate the contract number to which your tax election applies, avoiding any dashes.

- In Section 2, input the relevant contract numbers. This includes the TIAA number, CREF number, plan number, sub-plan number, and plan name.

- Move to Section 3 to make your withholding election. Select your marital status and specify the total number of withholding allowances you wish to claim. If you would like to withhold an additional amount from each payment, indicate that in the designated field.

- If applicable, select the percentage you wish to be withheld from the taxable portion of your payment for federal taxes, or choose not to have any taxes withheld.

- In the continuation of Section 3, if receiving a Transfer Payout Annuity, Interest Payment Retirement Option, or a shorter fixed period, indicate the percentage you wish to be withheld, ensuring it meets the minimum required rate.

- Sign the form in Section 4 using black or dark blue ink and provide today's date. Remember that digital signatures are not accepted.

- Once the form is completed, you can save any changes, download, print, or share the form as needed.

Take the next step in managing your tax withholding by completing your form online.

That is a 10% rate. You can have 10% in federal taxes withheld directly from your pension and IRA distribution so that you would receive a net $18,000 from your pension and $27,000 from your IRA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.