Loading

Get Au Nat 3092 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 3092 online

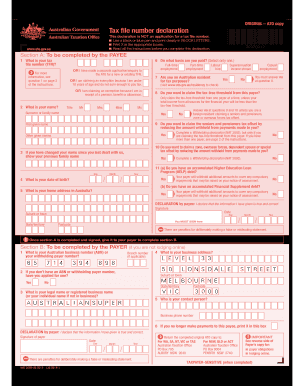

Filling out the AU NAT 3092 tax file number declaration form online is a straightforward process, but it requires attention to detail to ensure accuracy. This guide will provide you with clear steps to complete the form effectively, tailored to your needs.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to access the AU NAT 3092 form and open it in the editor.

- Begin by completing Section A, which is designated for the payee. Start by entering your tax file number (TFN) in the appropriate field. If you do not have a TFN, indicate your application status.

- Provide your name, ensuring to fill in the title and surname correctly, and add any given names in the respective fields.

- Record your date of birth, ensuring accuracy to avoid processing issues. Use the format Day/Month/Year.

- Fill in your home address in Australia, including suburb, state/territory, and postcode. Use BLOCK LETTERS and clear writing.

- Answer the questions regarding your employment status and residency for tax purposes by selecting the appropriate options.

- Indicate if you wish to claim the tax-free threshold, seniors and pensioners tax offset, or any special offsets as applicable.

- Make sure to complete the declaration section by signing the document and dating it accurately.

- Once Section A is completed and signed, submit it to your payer for them to fill out Section B, if necessary.

- Finally, review the entire form for accuracy before saving or sharing it as needed. You can download, print, or share the completed document.

Start filling out your AU NAT 3092 form online today for a hassle-free experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Completing a withholding exemption form requires you to provide your personal information and the reasons for claiming an exemption from tax withholding. This form is crucial for ensuring that you are not over-taxed on your earned income. For guidance on how to accurately fill out this form, refer to templates and resources available on the US Legal Forms platform.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.