Loading

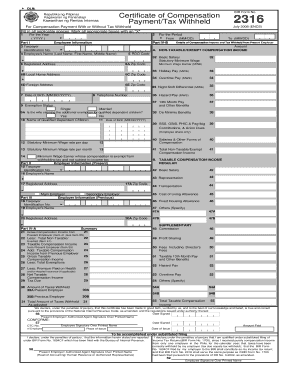

Get Ph Bir 2316 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 2316 online

Filling out the PH BIR 2316 online is an essential process for employees to declare their compensation income and tax withheld. This guide will provide clear and detailed instructions to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the PH BIR 2316 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the year for which the compensation was received in the designated field. Ensure that the format is in YYYY.

- Proceed to fill out Part I for Employee Information. Enter the Taxpayer Identification Number followed by the employee's full name, including Last Name, First Name, and Middle Name.

- Indicate the compensation period by filling in the 'From' and 'To' dates in MM/DD format.

- In Part IV-B, detail the compensation income. Start by entering the RDO Code and the relevant amounts for non-taxable or exempt compensation income such as basic salary, holiday pay, overtime pay, and other allowances.

- Fill in the employee’s details, including Date of Birth and Telephone Number. Specify the exemption status and any qualifiers for dependent children.

- Complete Part II by entering the Employer Information. Include the Taxpayer Identification Number and the name and address of the present employer.

- In Part III, if applicable, provide the previous employer's Taxpayer Identification Number and name, as well as their registered address.

- Summarize the gross compensation income in Part IV-A by calculating the amounts for taxable and non-taxable income, and detail any deductions or allowances.

- Finalize the form by reviewing the total amounts for taxes due and taxes withheld. Ensure all signatures are provided where indicated, including those of the present employer and employee.

- Once all fields are completed, users can save their changes, download, print, or share the form as needed.

Start filling out the PH BIR 2316 online now for a smooth and efficient process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, in the Philippines, taxes are generally deducted automatically from your paycheck. Employers withhold these taxes and report them through forms like the PH BIR 2316. This system helps you manage your tax obligations efficiently, ensuring you remain compliant with the law.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.