Loading

Get E2wxoik02bi Site Youtube Com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E2wxoik02bi Site Youtube Com online

This guide provides clear and concise instructions on how to effectively fill out the E2wxoik02bi Site Youtube Com. By following these steps, users can navigate the form with ease and confidence.

Follow the steps to complete your form successfully.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

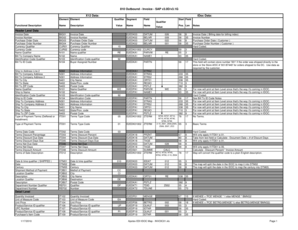

- Begin by filling out the invoice date. This is the date you are submitting the invoice.

- Next, enter the invoice number in the corresponding field. Ensure that this number is unique to avoid confusion.

- Input the purchase order date. This should reflect the date of the corresponding purchase order.

- Fill in the purchase order number, which is typically provided by the buyer.

- Select the currency qualifier relevant to your transaction and then specify the corresponding currency code.

- In the bill-to section, input the name of the company being billed and their identification code.

- Continue filling out the shipping address fields, including company name, address lines, city, state, and ZIP code.

- Identify the payment terms by choosing from deferred or installment options, if applicable.

- Review all entered information to ensure it is accurate and complete.

- Once all sections are completed, save the changes, download, print, or share the form as needed.

Take the next step towards efficient document management by completing your documents online.

Multiplying depreciation by the interest rate gets you the total lease payment before sales tax. If you're paying monthly sales tax, you'll multiply that amount by the applicable sales tax rate to get your total lease payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.