Loading

Get California Tire Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California Tire Fee Return online

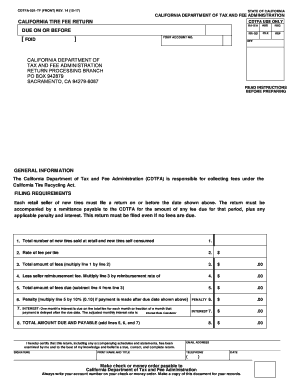

The California Tire Fee Return is an essential document for retail sellers of new tires, ensuring compliance with the California Tire Recycling Act. This guide will provide you with clear, step-by-step instructions on how to successfully complete the form online.

Follow the steps to complete the California Tire Fee Return online.

- Click the ‘Get Form’ button to obtain the California Tire Fee Return and open it in the online editor.

- In the section labeled 'Your Account No.', enter your unique account number as assigned by the California Department of Tax and Fee Administration (CDTFA).

- For line 1, input the total number of new tires sold at retail, including any tires sold to government entities or those self-consumed, meaning used internally rather than sold.

- On line 2, enter the current rate of the tire fee per tire, as per the latest regulations.

- Calculate the total amount of fees for line 3 by multiplying the number of tires from line 1 by the fee rate entered in line 2.

- For line 4, calculate the seller reimbursement fee by taking 1.5% of the total fees from line 3. Provide this amount.

- On line 5, determine the total amount of fees due by subtracting the reimbursement amount in line 4 from the total fees in line 3.

- If applicable, enter any penalties for late payment on line 6, which is 10% of the fees due if the payment is past the due date.

- For line 7, enter any interest due on the total fees for each month the payment is delayed after the due date.

- Complete line 8 by adding the amounts from lines 5, 6, and 7, which will give the total amount due and payable.

- Finally, certify the return by providing your signature, print name, title, email address, and telephone number. Save, download, print, or share the completed form as necessary.

Complete your California Tire Fee Return online today to ensure compliance and avoid penalties.

Related links form

The California Tire Fee (tire fee) is imposed on the purchaser (customer) of a new tire and collected by the retailer at the time of the sale. The retailer must report and pay the tire fee to us.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.