Loading

Get Mw506am Amended Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MW506AM amended return online

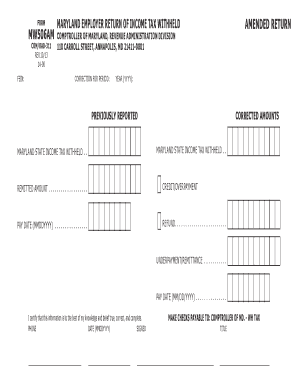

Filling out the MW506AM amended return online is an essential process for correcting any previously reported income tax withheld in Maryland. This guide provides step-by-step instructions to ensure that users can complete the form accurately and efficiently, enabling smooth submission and compliance.

Follow the steps to complete the MW506AM amended return online effectively

- Click the ‘Get Form’ button to obtain the MW506AM amended return and open it in your preferred document editor.

- Locate the FEIN section at the top of the form and enter your Federal Employer Identification Number. This helps identify your business.

- Move on to the correction for period section and specify the tax year you are amending by entering the four-digit year (YYYY).

- In the previously reported Maryland state income tax withheld field, enter the amount that was originally submitted.

- Next, in the corrected amounts section, provide the accurate Maryland state income tax withheld amount that needs to be reported.

- Enter the remitted amount in the corresponding field, ensuring that it accurately reflects any payments made.

- For any credits or overpayments, include the relevant amounts in the appropriate section.

- In the pay date field, specify the date of payment using the MMDDYYYY format.

- If applicable, fill in the refund amount that you are requesting in the designated section.

- Address any underpayment or remittance details as necessary in the sections provided.

- Again, in the pay date field, provide the relevant date using the MM/DD/YYYY format.

- In the certification section, ensure to provide your phone number, date of signing (MMDDYYYY), and your signature to validate the accuracy of the information provided.

- Finally, make checks payable to the Comptroller of Maryland - WH Tax, as indicated on the form.

- Review all attached explanation of changes to clarify your amendments and ensure all information is accurate.

Complete your MW506AM amended return online today!

Comptroller of Maryland Payment Processing PO Box 8888 Annapolis, MD 21401-8888 To make an online payment, scan this QR code and follow instructions. A T T ACH CHECK OR MONEY ORDER HERE WITH ONE ST APLE. line of your Forms 502 and 505, Estimated Tax Payments and Extension Payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.