Loading

Get Declaration Under Probate Code Section 13101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration Under Probate Code Section 13101 online

This guide provides clear and supportive instructions on how to complete the Declaration Under Probate Code Section 13101 online. By following these steps, users will be able to effectively fill out and submit the necessary documentation to claim unclaimed property of a decedent in California.

Follow the steps to complete the declaration online:

- Click ‘Get Form’ button to access the Declaration Under Probate Code Section 13101. This will allow you to retrieve the necessary document for completion.

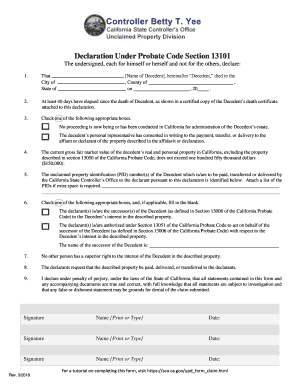

- In Section 1, input the name of the decedent, the location (city and county), and the date of death. This information can typically be found on the decedent’s death certificate.

- In Section 2, confirm that at least 40 days have passed since the decedent's death, as indicated by a certified copy of the death certificate that you must attach.

- In Section 3, check the appropriate box. Select the first box if there are no ongoing or previous court proceedings to administer the decedent's estate. Choose the second box if you have written consent from the decedent’s personal representative for the claim.

- Proceed to Section 4 to confirm that the total value of the decedent's property does not surpass $150,000. This is crucial for eligibility to use this form.

- For Section 5, list all property identification numbers (PID) associated with the decedent's unclaimed property. Ensure you attach a separate list if needed.

- In Section 6, check the appropriate box indicating your relationship or authority regarding the decedent’s estate. Fill in any required details about the successor or representative.

- In Section 7, affirm that no one has a superior right to the interest you are claiming from the decedent.

- In Section 8, request that the described property be duly paid, delivered, or transferred to you.

- In Section 9, declare under penalty of perjury that the information you provided is accurate and truthful. This is a critical affirming statement.

- Finally, sign and date the form. Ensure all involved parties print their names clearly and provide their signatures in the designated areas.

Complete your declaration online today to claim the unclaimed property of your loved one.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An affidavit or declaration signed under penalty of perjury at least 40 days after the death can be used to collect the assets for the beneficiaries or heirs of the estate. No documents are required to be filed with the Superior Court if the small estates law (California Probate Code Sections 13100 to 13116) is used.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.