Loading

Get Ps 425

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ps 425 online

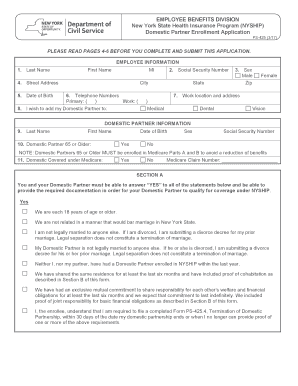

Filling out the Ps 425, the Domestic Partner Enrollment Application for the New York State Health Insurance Program, is a straightforward process. This guide will provide you with clear, step-by-step instructions to ensure your application is completed accurately and efficiently.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to access the Ps 425 document and open it for editing.

- In the 'Employee Information' section, enter your last name, first name, middle initial, and social security number. Fill in your street address, city, state, zip code, date of birth, and telephone numbers.

- Specify your gender by selecting either 'Male' or 'Female'. Indicate which type of coverage you wish to add for your Domestic Partner by checking the appropriate boxes for medical, dental, or vision.

- In the 'Domestic Partner Information' section, provide your Domestic Partner's last name, first name, and social security number. Indicate whether your Domestic Partner is 65 or older and if they are covered under Medicare.

- Affirm your eligibility for coverage under Section A by answering 'Yes' to all listed statements. Be prepared to provide the necessary documentation.

- In Section B, ensure you submit the required proofs of joint responsibility for financial obligations and proof of cohabitation as specified in the application.

- In Section C, determine if your Domestic Partner is a federally qualified dependent according to the Internal Revenue Code and check the corresponding box.

- After filling out all sections, save your changes. You can download, print, or share the completed form as needed.

Complete your Ps 425 application online today to ensure your Domestic Partner is enrolled in the NYSHIP program.

The fair market value of the health insurance benefits is treated as income for tax purposes whether or not your Domestic Partner qualifies as a dependent under the IRS rules. The employee's extra cost for domestic partner coverage cannot be paid with pre-tax dollars.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.