Loading

Get R 6180

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R 6180 online

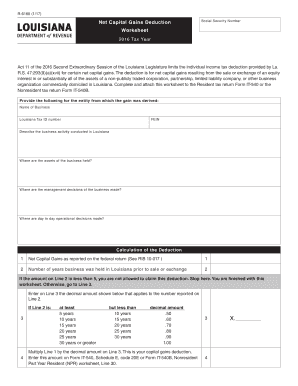

Filling out the R 6180 form is essential for claiming the net capital gains deduction for the 2016 tax year. This guide provides you with step-by-step instructions to ensure accurate completion of this form, even if you have little experience with legal documents.

Follow the steps to complete the R 6180 online accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your Social Security Number in the designated field.

- Provide the name of the business generating the net capital gains.

- Fill in the Louisiana Tax ID number for the business.

- Enter the Federal Employer Identification Number (FEIN) for the business.

- Describe the business activity conducted in Louisiana in the provided space.

- Indicate where the business assets are held.

- Specify where the management decisions for the business are made.

- Outline where day-to-day operational decisions are made.

- Report the net capital gains as they appear on your federal return.

- Document the number of years the business was held in Louisiana prior to the sale or exchange.

- If the number entered in Step 11 is less than 5, you cannot claim this deduction. If it is 5 or greater, refer to the calculations to multiply the net capital gains by the applicable decimal amount based on the number of years held.

- Multiply the amount from Step 10 by the decimal amount determined in Step 12 to calculate your capital gains deduction.

- Enter the calculated deduction on Form IT-540, Schedule E, code 20E or Form IT-540B, Nonresident Part Year Resident (NPR) worksheet, Line 30.

- Gather additional documentation required, such as a notarized statement, previous tax returns, and relevant K-1 forms.

- Once all information is completed, save changes, download, print, or share the form as necessary.

Start filling out the R 6180 form online to ensure you maximize your net capital gains deduction.

The IRS defines a net capital gain as the amount by which net long-term capital gain (long-term capital gains minus long-term capital losses and any unused capital losses carried over from prior years) exceeds net short-term capital loss (short-term capital gain minus short-term capital loss).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.