Loading

Get Hud-1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HUD-1 online

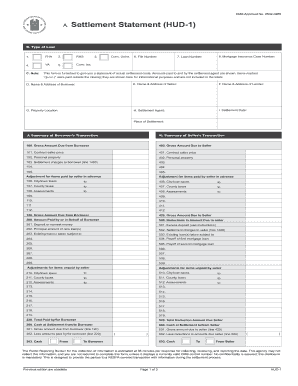

The HUD-1 form is a document that outlines the actual settlement costs incurred during a real estate transaction. This guide offers a clear, step-by-step approach to filling out the HUD-1 online, ensuring you understand each component of the form for an accurate submission.

Follow the steps to successfully complete your HUD-1 form online.

- Click ‘Get Form’ button to obtain the HUD-1 form and open it in the editor.

- Begin by completing Section A, which includes the type of loan. Select from options such as FHA, RHS, VA, and specify the mortgage insurance case number.

- In Section D, enter the name and address of the borrower, followed by the seller's details in Section E, and the lender's information in Section F.

- Fill out Section G with the property location and Section H with the settlement agent's information.

- Date of settlement and place of settlement should be documented in Section I.

- In Section J, summarize the borrower's transaction, ensuring all relevant gross amounts, sales prices, and adjustments are included.

- Section K will require you to summarize the seller's transaction. This should reflect all figures related to the amounts due, adjustments, and any outstanding items.

- Proceed to Section L and detail the settlement charges, including real estate broker fees, items payable in connection with the loan, and any required payments in advance.

- Conclude by reviewing all entries for accuracy and completeness. Ensure total settlement charges are correctly entered on the appropriate lines.

- Once you have completed your entries, you may now save changes, download, print, or share the HUD-1 form as needed.

Start filling out your HUD-1 form online today to ensure a smooth settlement process.

Related links form

You can obtain your HUD-1 from your closing agent or lender involved in your transaction. If you need a copy after closing, contact them to request the document. Additionally, if you are looking for templates or samples to understand the format better, U.S. Legal Forms offers a range of resources to assist you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.