Get Company Tax Return Ct600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015 online

How to fill out and sign Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The days of terrifying complex legal and tax documents have ended. With US Legal Forms the entire process of submitting legal documents is anxiety-free. A powerhouse editor is already at your fingertips supplying you with various useful instruments for filling out a Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015. The following tips, in addition to the editor will assist you with the complete procedure.

- Click the orange Get Form option to start modifying.

- Turn on the Wizard mode on the top toolbar to obtain extra pieces of advice.

- Fill out each fillable field.

- Ensure that the information you fill in Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015 is updated and accurate.

- Indicate the date to the sample with the Date feature.

- Click on the Sign tool and create a digital signature. You can find three available options; typing, drawing, or capturing one.

- Double-check each field has been filled in correctly.

- Select Done in the top right corne to save the file. There are several choices for receiving the doc. An attachment in an email or through the mail as a hard copy, as an instant download.

We make completing any Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015 less difficult. Get started now!

How to edit Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015: customize forms online

Have your stressless and paper-free way of editing Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015. Use our trusted online option and save tons of time.

Drafting every document, including Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015, from scratch takes too much time, so having a tried-and-true platform of pre-uploaded document templates can do wonders for your efficiency.

But editing them can be struggle, especially when it comes to the documents in PDF format. Fortunately, our huge catalog includes a built-in editor that lets you quickly fill out and customize Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015 without the need of leaving our website so that you don't need to lose time executing your paperwork. Here's what you can do with your form using our tools:

- Step 1. Locate the required document on our website.

- Step 2. Hit Get Form to open it in the editor.

- Step 3. Use our professional editing features that let you add, remove, annotate and highlight or blackout text.

- Step 4. Generate and add a legally-binding signature to your form by utilizing the sign option from the top toolbar.

- Step 5. If the template layout doesn’t look the way you need it, use the features on the right to erase, include, and re-order pages.

- step 6. Add fillable fields so other persons can be invited to fill out the template (if applicable).

- Step 7. Pass around or send the document, print it out, or choose the format in which you’d like to download the file.

Whether you need to execute editable Company Tax Return CT600 (2017) Version 3. For Accounting Periods Starting On Or After 1 April 2015 or any other template available in our catalog, you’re on the right track with our online document editor. It's easy and safe and doesn’t require you to have particular tech background. Our web-based tool is set up to handle virtually everything you can think of when it comes to document editing and completion.

No longer use conventional way of working with your forms. Go with a a professional solution to help you streamline your tasks and make them less reliant on paper.

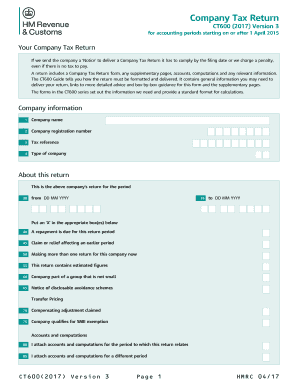

A CT600 form is part of a Company Tax Return. The form and other supporting documents constitute the Company Tax Return, which must be submitted to HMRC if a company receives a 'Notice to Deliver a Company Tax Return'. Limited companies use the information in a CT600 form to calculate the Corporation Tax that they owe.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.