Loading

Get Free Pay Stub Templates Smartsheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Free Pay Stub Templates Smartsheet online

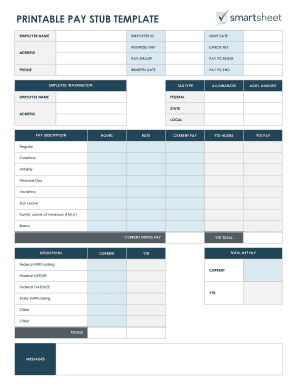

Filling out the Free Pay Stub Templates Smartsheet is essential for accurately documenting employee compensation. This guide will help you navigate each section of the pay stub template, ensuring that all necessary information is included and presented clearly.

Follow the steps to fill out the pay stub template with confidence.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the employer name in the designated field at the top of the form. This identifies the organization issuing the pay stub.

- Fill in the employee ID to uniquely identify each employee associated with the pay stub.

- Input the issue date to indicate when the pay stub is being generated.

- Complete the business unit, check number, and pay group sections as applicable to accurately categorize the employee's pay.

- Document the pay period begin and end dates to specify the timeframe for which the earnings are applicable.

- Provide the address and phone information for the employer, which may assist in any necessary communications.

- Enter employee information including their name, allowances, any additional amounts, and year-to-date hours and pay.

- Specify the tax type along with the relevant federal and state tax withholdings to ensure compliance with tax regulations.

- Outline the pay description, detailing the hours worked and rates for each type of pay such as regular, overtime, and additional pay categories like bonuses.

- Calculate and enter the current gross pay, along with any deductions which should also be categorized into current and year-to-date totals.

- Finally, ensure the total net pay is accurately calculated and double-check all entries for accuracy.

- Once all fields are completed, save your changes, and explore options to download, print, or share the completed pay stub.

Start filling out your pay stub template online today for accurate record-keeping!

W-2s, 1099s, and tax returns In lieu of showing your pay stubs, a W-2 Wage and Tax Statement can also be used to verify income. Some people like freelancers, contract workers, and entrepreneurs receive a 1099-MISC form. A 1099 is also issued for interest and dividends, and government payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.