Loading

Get Texas Agricultural And Timber Exemption Forms - Texas Comptroller

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Agricultural And Timber Exemption Forms - Texas Comptroller online

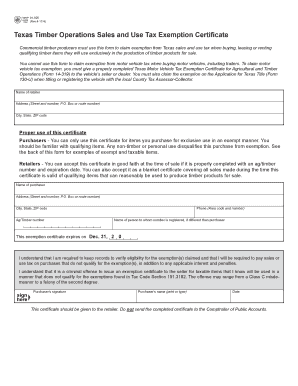

Filling out the Texas Agricultural And Timber Exemption Forms can be straightforward if you follow the right steps. This guide provides detailed instructions to help you complete the form accurately for claiming exemptions from sales and use tax related to timber operations.

Follow the steps to successfully complete the exemption form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the name of the retailer, ensuring that you provide a complete address including street number, P.O. Box if applicable, city, state, and zip code.

- Next, input your name as the purchaser along with your address details — including street and number, P.O. Box, city, state, and ZIP code. Make sure to also include your agricultural or timber number.

- In the designated section, confirm your understanding of the responsibilities associated with the exemption, including the need to maintain records for verification.

- Include the name of the person registered with the ag/timber number if it is different from the purchaser.

- Carefully read the legal implications and ensure your understanding of the consequences for issuing an exemption certificate for non-qualifying items.

- Sign and print your name as the purchaser in the provided area, then write the date of completion.

- Once you have completed the form, ensure you provide it to the retailer and do not send it to the Comptroller of Public Accounts.

- Finally, save any changes, download, print, or share the completed form as needed.

Start completing your Texas Agricultural And Timber Exemption Forms online today!

All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (ag/timber number) issued by the Comptroller to claim exemption from Texas tax. If you do not have a valid ag/timber number, you must pay tax to retailers on your purchases.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.