Loading

Get Employer's Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employer's Return online

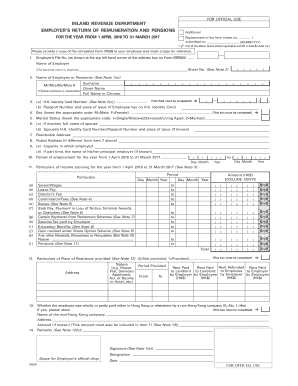

Filling out the Employer's Return is essential for complying with taxation requirements. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the employer's return online.

- Press the ‘Get Form’ button to access the Employer's Return document and open it in your preferred PDF editor.

- Enter the employer’s file number as indicated on Form BIR56A at the top left corner.

- Fill in the name of the employer as required.

- Complete the sheet number, ensuring it corresponds with the submitted form.

- Provide the full name of the employee or pensioner. Include the surname and given name, and if applicable, their full name in Chinese.

- If the employee possesses a Hong Kong Identity Card, enter the number. If not, provide the passport number and the place of issue.

- Indicate the employee's sex by inserting 'M' for male or 'F' for female.

- Specify the marital status using the appropriate code: 1 for single/widowed/divorced/living apart, or 2 for married.

- If married, input the full name of the spouse along with their Hong Kong Identity Card number or passport number and place of issue, if known.

- Enter the residential address of the employee.

- If the postal address differs from the residential address, fill in this section accordingly.

- Indicate the capacity in which the employee is employed and, if part-time, provide the name of their principal employer.

- Complete the period of employment for the specified year from 1 April 2016 to 31 March 2017 by providing the start and end dates.

- Detail the particulars of income accrued for the specified year, filling in each field for salary, bonuses, and other income types.

- Provide particulars of any accommodations provided, including rent details.

- Determine whether the employee was paid by a non-Hong Kong company and include the relevant details if applicable.

- Complete the remarks section if necessary.

- Sign the form and affix the employer’s official chop where indicated.

- After completing the form, save your changes, then download, print, or share the completed Employer's Return as required.

Stay compliant by completing your documents online today!

Related links form

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.