Loading

Get Modelo Sc 2644

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Modelo Sc 2644 online

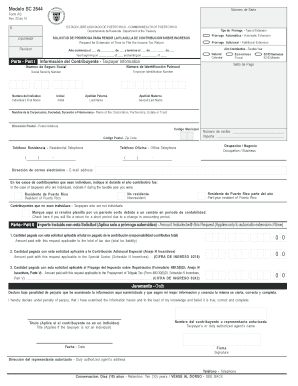

The Modelo Sc 2644 is a crucial form for taxpayers in Puerto Rico seeking to apply for an extension of time to file their income tax return. This guide will provide clear, step-by-step instructions to help you successfully complete this form online, ensuring that you provide all necessary details accurately.

Follow the steps to fill out the Modelo Sc 2644 online.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Enter the year of the taxable period in the provided fields, indicating the start and end dates.

- Select the type of extension you are applying for. Choose between 'Automatic Extension' or 'Additional Extension'.

- In Part I, fill out the Taxpayer Information section. Provide your full name, postal address, and Social Security or Employer Identification Number as required.

- Complete the occupation/business field with your primary job or business activity.

- Enter your residential and office telephone numbers in the designated fields, including area codes.

- If applicable, select your residency status during the taxable year. Indicate if you were a resident, nonresident, or part-year resident of Puerto Rico.

- Move to Part II and report any payments included with the request in the designated areas. This includes amounts for special surcharges and prepayments if applicable.

- In Part III, check the appropriate box indicating your type of taxpayer for the automatic extension.

- If you require an additional extension, fill out Part IV, ensuring to provide evidence of being outside of Puerto Rico, if applicable.

- Sign the form electronically, affirming that the information provided is true and complete under penalty of perjury.

- Finally, save your changes to the form, and download, print, or share it as needed.

Complete and submit the Modelo Sc 2644 online today to ensure timely compliance with your tax obligations.

Related links form

About the Puerto Rico Sales Tax The Puerto Rico Sales and Use Tax, or the "Impuesto a las Ventas y Uso (IVU)" in Spanish, consists of a 10.5% commonwealth-wide sales and use tax and a 1% local-option sales tax that is distributed to the city in which it is collected.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.