Loading

Get Lien Holder Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lien Holder Agreement online

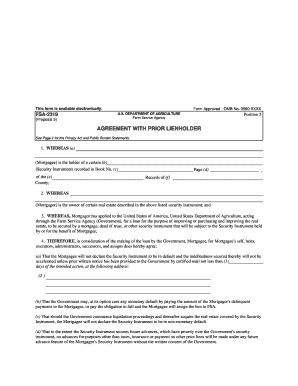

Completing the Lien Holder Agreement online is a straightforward process that helps facilitate financial agreements between lienholders and the federal government. This guide will walk you through the steps to fill out this essential document with clarity and confidence.

Follow the steps to successfully complete the Lien Holder Agreement.

- Click ‘Get Form’ button to obtain the Lien Holder Agreement form and open it in your preferred online editor for filling out.

- In the first section, indicate the name of the mortgagee in the designated field. This refers to the entity or individual that holds the lien on the property.

- Next, provide details of the security instrument. This includes the type (e.g., mortgage or deed of trust) and its relevant recorded information including the book number.

- Proceed to fill in the county where the security instrument is recorded, ensuring accuracy to avoid processing delays.

- In the following sections, confirm the identity of the mortgagor and complete the necessary details regarding the real estate described in the security instrument.

- Review the agreement's terms in the clauses provided. Ensure all details concerning notification and actions by the mortgagee are completed correctly.

- Complete the signature section where the mortgagee will sign and date the document. Make sure to include their title for verification.

- Review all filled sections for accuracy before finalizing. Confirm that any required acknowledgments related to privacy and burden statements are noted.

- Once confirmed, you can save changes, download a copy, print it for your records, or share it according to your needs.

Start completing your Lien Holder Agreement online today to ensure timely processing of your financial arrangements.

Related links form

A lienholder is a lender that legally has an interest in your property until you pay it off in full. The lender — which can be a bank, financial institution or private party — holds a lien, or legal claim, on the property because they lent you the money to purchase it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.