Loading

Get Tp-1.d.d-v(2014-12). Tp-1.d.d-v(2014-12)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TP-1.D.D-V(2014-12) online

Filling out the TP-1.D.D-V(2014-12) form online can seem overwhelming at first, but with a clear guide, you can navigate the process smoothly. This guide provides step-by-step instructions to help you complete the Solidarity Tax Credit Schedule effectively.

Follow the steps to successfully complete the TP-1.D.D-V(2014-12) form online.

- Use the ‘Get Form’ button to access the TP-1.D.D-V(2014-12) document and open it in your preferred online editor.

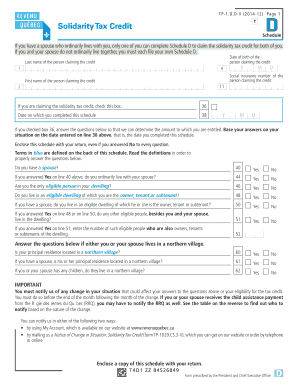

- Begin by entering the date of birth of the person claiming the credit. This is important for eligibility verification. Fill in the last name and first name of the person in the designated fields.

- Provide the social insurance number for the individual claiming the credit in the specified area.

- If you intend to claim the solidarity tax credit, check the corresponding box to indicate your intention.

- Record the date when you completed this schedule in the appropriate field using the format year, month, and day.

- Answer the questions regarding your living situation and eligibility for the credit. Each question requires a 'Yes' or 'No' response, so be sure to read each question carefully and respond accurately.

- If applicable, provide additional information as requested to determine the amount of the credit. This may include details about your dwelling and any eligible persons living with you.

- Before submitting, review all the answers for accuracy to ensure you meet the eligibility requirements for the solidarity tax credit.

- Once you have filled in all required fields and reviewed your responses, you can save changes, download, or print the completed form for your records or submission.

Complete your TP-1.D.D-V(2014-12) online today for a smoother filing experience!

Confused about which ITR form to use for filing taxes? ITR 1 is for residents with income from salaries and other sources, ITR 2 is for those without business income, and ITR 4 is for those using presumptive taxation. The ITR filing season is in full swing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.