Loading

Get 2015 Instruction 1040 Schedule. 2015 Instructions For Schedule 8812, Child Tax Credit - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Instruction 1040 Schedule 8812, Child Tax Credit - IRS online

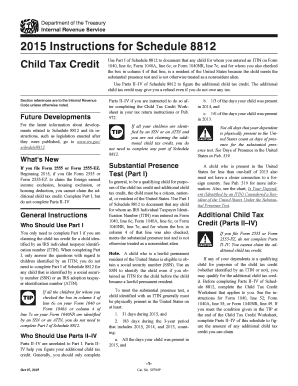

This guide provides a user-friendly and comprehensive approach to completing the 2015 Instruction 1040 Schedule 8812 for claiming the Child Tax Credit. It is designed for individuals with varying levels of tax knowledge and aims to simplify the process of filling out the form accurately.

Follow the steps to fill out your 2015 Schedule 8812

- Press the 'Get Form' button to access the 2015 Schedule 8812 form and open it in your preferred editing tool.

- Review Part I of Schedule 8812. This section is necessary if you are documenting a child for whom you provided an Individual Taxpayer Identification Number (ITIN) in your 1040 forms and checked the corresponding box, ensuring that the child meets the substantial presence test.

- In Part I, fill out each line for every dependent identified by an ITIN. This includes establishing whether they meet the substantial presence test, making sure to answer each query based on the child's presence in the United States.

- If you have more than four children for whom you need to complete Part I, check the box after Line D. Continue to fill out additional pages as needed.

- Move to Parts II–IV of Schedule 8812 if you are considering the additional child tax credit. Follow the relevant instructions based on the Child Tax Credit Worksheet to fill out this section accurately.

- Complete the additional calculations necessary for Parts II–IV, entering amounts where prompted, such as nontaxable combat pay and your earned income from previous forms.

- After filling in all relevant sections of the form, review your entries for accuracy and completeness.

- Finally, once you are satisfied with your form, you may save changes, download, print, or share it as required.

Complete your 2015 Schedule 8812 online now to ensure you maximize your child tax credit benefits.

To receive the additional child tax credit, you first need to be eligible for the child tax credit by having (and claiming) at least one qualifying child. A qualifying child must be ... Claimed as a dependent on your federal income tax return. Not filing a joint return for the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.