Loading

Get 50-162 Appointment Of Agent For Property Tax Matters

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 50-162 Appointment Of Agent For Property Tax Matters online

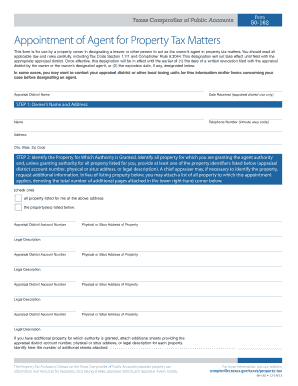

The 50-162 Appointment Of Agent For Property Tax Matters is an essential document designed for property owners to designate an agent for handling property tax matters. This guide provides comprehensive step-by-step instructions on filling out the form online, ensuring ease and clarity for users of all backgrounds.

Follow the steps to complete your form efficiently.

- Use the ‘Get Form’ button to download the 50-162 form and open it in your preferred editor.

- Enter your name and contact information in the designated Owner's Name and Address section. Make sure to include your telephone number, address, city, state, and zip code.

- Identify the property or properties for which you are granting authority. Indicate whether it applies to all properties associated with your address or specify the properties using the appraisal district account number, physical or situs address, or legal description. If necessary, attach additional sheets for more properties and indicate the total number attached.

- Provide details about the agent you are appointing. Include their name, contact number, address, city, state, and zip code.

- Specify the scope of the agent's authority. Choose whether the agent is authorized for all property tax matters or only specific matters. Indicate if they are authorized to receive confidential information.

- Indicate the type of documents the agent should receive regarding your property. You can select whether they should receive all communications from the chief appraiser, appraisal review board, and taxing units.

- Specify the date when the agent's authority ends. This is the date when the designation becomes invalid unless revoked earlier.

- Sign and date the form in the Identification, Signature, and Date section. Include your printed name and title, ensuring that the form is signed by an authorized person. Review to ensure all sections are filled out correctly.

- Finally, save your changes and decide whether to download, print, or share the completed document as needed.

Complete your 50-162 Appointment Of Agent For Property Tax Matters form online today for a streamlined process.

Related links form

Section 1.04(7) of the Texas Property Tax Code defines “market value” as the price at which a property would transfer for cash or its equivalent under prevailing market conditions if: • Exposed for sale in the open market with a reasonable time for the seller to find a purchaser, • both the seller and the purchaser ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.