Loading

Get D-407 Nc K-1 - Dor.state.nc.us

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D-407 NC K-1 - Dor.state.nc.us online

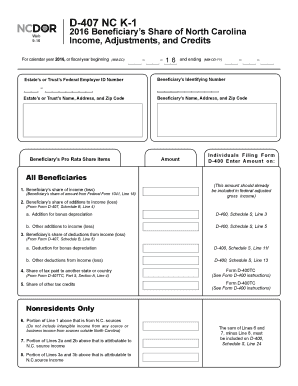

The D-407 NC K-1 form is an important document for beneficiaries to report their share of income, adjustments, and credits for North Carolina tax purposes. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently online.

Follow the steps to complete the D-407 NC K-1 form online.

- Click the ‘Get Form’ button to obtain the D-407 NC K-1 form and open it in your preferred online tool.

- Begin by entering the estate’s or trust’s federal employer identification number, located at the top of the form. This number identifies the entity for tax purposes.

- Fill in the beneficiary's identifying number. This is important for linking the income to the correct individual.

- Complete the section stating the estate’s or trust’s name, address, and zip code to provide necessary contact information.

- Input the beneficiary’s name, address, and zip code in the next section, ensuring all information is accurate and up to date.

- In the Beneficiary’s Pro Rata Share Items section, enter the appropriate amounts for each item, including income (or loss), adjustments to income (or loss), and deductions (from income or loss). Reference applicable lines from related forms for accurate reporting.

- For nonresidents, be sure to specify which portions of the amounts reported are attributable to North Carolina sources. This includes breaking down amounts for income, additions, and deductions as necessary.

- After completing all fields, review the information for accuracy. You can then save the changes, download a copy, print it, or share the completed form as needed.

Start filling out the D-407 NC K-1 form online today to ensure accurate reporting of your income and adjustments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The state of North Carolina does offer a standard deduction for taxpayers based on filing status: Single – $12,750 standard deduction. Married Filing Jointly/Qualifying Widow(er)/Surviving Spouse – $25,500. Married Filing Separately. Spouse does not claim itemized deductions – $12,750. ... Head of Household – $19,125.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.