Loading

Get City Of Ashland Ky Net Profit License Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Ashland Ky Net Profit License Fee Return online

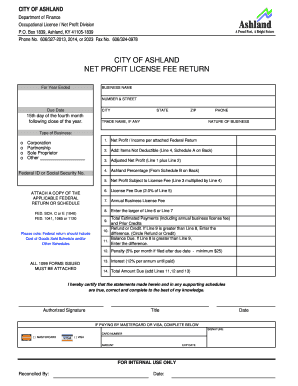

Filling out the City Of Ashland Ky Net Profit License Fee Return is an essential step for businesses to ensure compliance with local regulations. This guide will walk you through each section of the form, providing detailed instructions to make the process straightforward and accessible.

Follow the steps to complete your net profit license fee return online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your business name and address in the designated fields, including the number and street, city, state, and zip code.

- Complete the trade name field if applicable, along with your phone number and nature of business.

- Indicate the type of business you operate (choose from corporation, partnership, sole proprietor, or other).

- Input your net profit or income as reported on your attached federal return.

- Add any items not deductible from Schedule A into the respective field.

- Calculate your adjusted net profit by adding Lines 1 and 2 together.

- Find the Ashland percentage from Schedule B and enter it in the designated field.

- Multiply your adjusted net profit by the Ashland percentage to find your net profit subject to license fee.

- Calculate the license fee due by taking 2.0% of Line 5.

- Enter your annual business license fee in the field provided.

- For total fees, enter the larger amount of Line 6 or Line 7 in Line 8.

- If applicable, calculate and enter any total estimated payments or prior credits in Line 9.

- If Line 9 exceeds Line 8, indicate the refund or credit amount; otherwise, if Line 8 is greater, enter the balance due.

- Complete the section for penalties if applicable and calculate any interest owed until the amount is paid.

- Sum Lines 11, 12, and 13 to determine the total amount due.

- Sign the form to certify that the information is correct, and include your title and date.

- If paying by credit card, fill out the payment information section.

Start filling out your City Of Ashland Ky Net Profit License Fee Return online today!

What is the sales tax rate in Mayfield, Kentucky? The minimum combined 2023 sales tax rate for Mayfield, Kentucky is 6%. This is the total of state, county and city sales tax rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.