Loading

Get Instruction For Form Ar1 - Nassaucountyny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instruction For Form AR1 - Nassaucountyny online

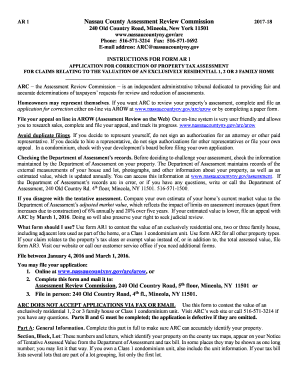

This guide provides users with a clear and comprehensive overview of how to complete the Instruction For Form AR1 online. By following these steps, users can effectively contest their property tax assessment.

Follow the steps to successfully complete the online form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the general information required in Part A. Fill out the section, block, and lot numbers, which identify your property. These can be found on your Notice of Tentative Assessed Value or tax bill. Include your property's full address and the names of any co-owners.

- Complete Part B, the Owner's Estimate of Full Market Value. This is crucial for your assessment appeal. Provide an estimate of what your house would likely sell for in a typical market situation.

- In Part C, provide your contact information and designate whether you are filing as yourself or authorizing a representative. Ensure that all your details, including address, phone number, and email, are accurate.

- Complete Part D, which asks for information about the property. Answer all questions to assist ARC in evaluating your claim.

- In Part E, specify your assessment request if desired. This may include the tentative assessment and your requested assessment using the appropriate calculations or evidence.

- Optionally, complete Part F by listing any recent sales of comparable houses to support your claim. Focus on sales within the last six months for the best relevance.

- Finally, in Part G, complete the Statement of Claim and Certification. Ensure you sign if filing on paper and make sure all information is legally sufficient.

- After completing all parts of the form, save your changes. You can then download, print, or share the form as necessary.

Begin filling out the Instruction For Form AR1 online today to ensure your property assessment is accurate.

The tax revenue required is divided by the assessed value of all property in the district to determine the tax rate. In most districts separate rates are determined for each class of property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.