Loading

Get (form 5208c-1)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the (Form 5208C-1) online

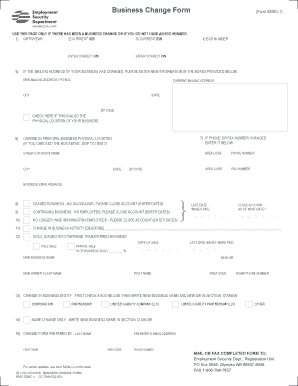

This guide provides clear instructions on how to fill out the (Form 5208C-1) online, specifically designed for users experiencing a business change or lacking an ESD number. Following these steps will help ensure that the form is completed accurately and efficiently.

Follow the steps to fill out the (Form 5208C-1) online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the quarter and year associated with the business change in the designated fields.

- Input the current UBI (Unified Business Identifier) and ensure it is correct.

- Enter the current EIN (Employer Identification Number) in the provided space.

- If there is a change in the mailing address, provide the new mailing address or PO box in the fields provided, along with the current mailing address, city, state, and ZIP code.

- Indicate if the new mailing address is also the physical location of the business by checking the box.

- If there are any changes to the phone or fax number, enter the new phone and fax numbers in the appropriate fields.

- If the principal business physical location has changed, fill in the street or route name, city, state, ZIP code, and both phone and fax number. If the new mailing address is also the physical location, skip this step.

- For ceased business scenarios, indicate that and provide the relevant dates.

- If continuing business with no employees, indicate this and provide the relevant dates.

- State if there are no longer any Washington employees and provide the dates for closing the account.

- Describe any change in business activity as necessary.

- If the business has been sold, leased, or transferred, indicate whether it is a full or partial sale and provide the date and percentage sold.

- If the business entity has changed, check the appropriate box and provide the new business name and UBI.

- Complete the form by adding the name and email address of the person who prepared the form.

- After filling out all sections, save changes, and choose to download, print, or share the completed form.

Take the next step by filling out your (Form 5208C-1) online today.

Officers of for-profit corporations who provide services in Washington are automatically exempt from Unemployment Insurance, unless the employer specifically requests coverage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.