Loading

Get Wrkngcp Eng

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wrkngcp Eng online

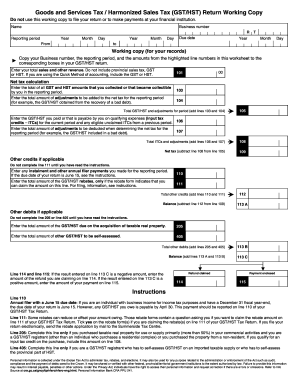

This guide provides a comprehensive overview of how to fill out the Wrkngcp Eng, a working copy for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return. By following the steps outlined here, you can ensure that your document is completed accurately and efficiently.

Follow the steps to fill out the Wrkngcp Eng online:

- Click the ‘Get Form’ button to obtain the form and open it in an editor.

- Begin by entering your name and business number. Ensure that these details are correctly input as they are crucial for identification.

- Fill in the reporting period with the appropriate year, month, and day. Make sure that the due date is also correctly filled out.

- Record your total sales and other revenue, excluding any provincial sales tax, GST, or HST. If applicable, include any GST or HST if you are using the Quick Method of accounting.

- For the net tax calculation, input the total GST and HST collected during the reporting period.

- Add any adjustments to the net tax on the corresponding line, including any GST/HST from recovery of bad debts.

- Total the GST/HST and adjustments for the period by adding the relevant line entries.

- Enter the GST/HST paid or payable on any qualifying expenses, specifically any input tax credits (ITCs) for the current period as well as eligible unclaimed ITCs.

- Deduct any adjustments relevant to determining the net tax for the reporting period, such as GST/HST included in a bad debt.

- Calculate the total ITCs and adjustments by summing the appropriate line entries.

- Determine the net tax by subtracting total ITCs and adjustments from the overall tax collected.

- If applicable, enter other credits, including any instalment and annual filer payments made during the reporting period.

- Input the total amount for any GST/HST rebates you are claiming on the form, ensuring that you refer to any instructions provided.

- Finally, review the balance and calculate whether you are claiming a refund or making a payment. Make sure all calculations are accurate before proceeding.

- Once everything is correctly filled out, you can save your changes, download the document, print it, or share it as required.

Complete your document online with ease and accuracy.

Related links form

I, the undersigned, being duly sworn, hereby affirm on _______that: My legal name is _______. ... 2.My social security number is: _______. I currently reside at the following address: ... My telephone number is: _______. I have presented my Notary public, as proof of my identity, the following valid issued ID: _______.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.