Loading

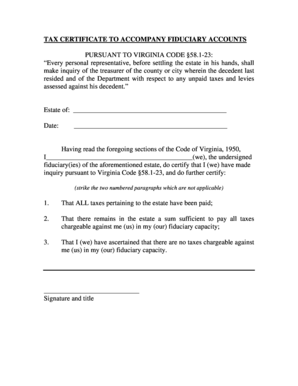

Get Tax Certificate To Accompany Fiduciary Accounts

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Certificate To Accompany Fiduciary Accounts online

Completing the Tax Certificate To Accompany Fiduciary Accounts is essential for personal representatives managing an estate in Virginia. This guide provides clear and supportive instructions to help you navigate the online form filling process effectively.

Follow the steps to complete the form accurately

- Press the ‘Get Form’ button to access the Tax Certificate and open it in the online editor.

- Enter the name of the estate in the designated space labeled 'Estate of'. This identifies the estate you are managing.

- Fill in the date on which you are completing the form. Ensure the date is accurate for record-keeping.

- As the fiduciary, provide your name in the section stating 'I (we), the undersigned fiduciary(ies) of the aforementioned estate, do certify that I (we) have made inquiry'.

- Review the two numbered paragraphs that follow. You must strike through the one that does not apply to your situation, ensuring only the relevant statement remains.

- If all taxes pertaining to the estate have been paid, you will keep the first statement. If there are outstanding taxes, you should retain the second statement indicating a sum sufficient to pay taxes.

- Sign and date the form in the provided area. Include your title as fiduciary to confirm your role.

- Once all fields are completed, you can choose to save changes, download, print, or share the completed form for submission.

Complete your tax certificate online today to ensure compliance and a smooth estate settlement.

While there is no inheritance tax in Virginia, another state's inheritance tax may apply if the inheritance you receive is from someone in that state. The state of Pennsylvania, for example, has an inheritance tax that applies to heirs who live in other states.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.