Loading

Get Cibc Summary Of Rates And Fees

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CIBC Summary of Rates and Fees online

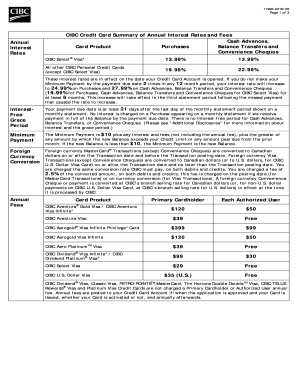

The CIBC Summary of Rates and Fees document provides essential information regarding credit card interest rates, fees, and related terms. This guide offers clear instructions on how to complete the form effectively and efficiently while ensuring all necessary information is provided.

Follow the steps to complete the CIBC Summary of Rates and Fees online.

- Press the ‘Get Form’ button to access the CIBC Summary of Rates and Fees document and open it for editing.

- Review the document sections regarding annual interest rates, including cash advances, purchases, and balance transfers. Make note of the rates applicable to your specific card type.

- Locate the interest-free grace period section to understand the payment due dates and how they impact interest charges on purchases.

- Fill out the minimum payment requirements box, ensuring you calculate any additional fees and amounts accurately based on your balance.

- Proceed to the foreign currency conversion section and detail the applicable fees and rates for any international transactions you may conduct.

- Identify and fill out the annual fees associated with your specific card product, including the primary cardholder and authorized user costs.

- Examine and document any other fees the card may incur, such as overlimit fees and statement copy fees, ensuring you fully understand the cost structure.

- Review the additional disclosures for vital information regarding dishonored payments and how they may affect your account.

- Once all sections are completed accurately, you can save your changes, download, print, or share the form as required.

Complete the CIBC Summary of Rates and Fees document online today to ensure you understand your credit card terms and fees.

Related links form

What Is the Minimum Payment on a Credit Card? The minimum payment on a credit card is the lowest amount of money the cardholder can pay each billing cycle to keep the account's status “current” rather than “late.” A credit card minimum payment is often $20 to $35 or 1% to 3% of the card balance, whichever is greater.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.