Loading

Get Payslip - Generic - With Wm

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payslip - Generic - With Wm online

This guide provides a clear overview of how to accurately complete the Payslip - Generic - With Wm online. Follow these detailed steps to ensure that you fill out all required sections correctly.

Follow the steps to complete your payslip effectively.

- Click the ‘Get Form’ button to obtain the Payslip - Generic - With Wm form and access it in your preferred digital editor.

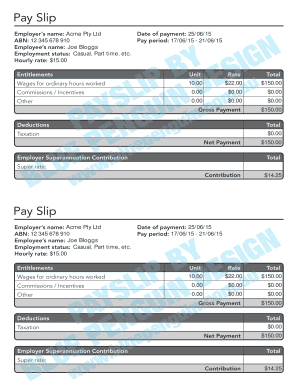

- Begin by entering your employer’s name at the top of the form. In this case, it is 'Acme Pty Ltd'. Next, fill in the ABN of the employer, which is '12 345 678 910'.

- Enter the date of payment. For this example, it is '25/06/15'. Additionally, indicate the pay period, which should be '17/06/15 - 21/06/15'.

- Provide the employee’s name, which is 'Joe Bloggs', along with their employment status. This can include terms such as 'Casual' or 'Part-time'.

- Input the hourly rate, which in this case is '$15.00'. Ensure this amount is accurate as it affects the calculations for wages.

- In the entitlements section, document the wages for ordinary hours worked. Enter the unit of hours worked, the rate per hour, and the total amount for those hours—e.g., for ten hours at a rate of '$22.00', the total is '$150.00'.

- If applicable, enter any commissions or incentives in their respective sections. Otherwise, input '0.00' for both the unit and total.

- Complete the deductions section by entering any taxation amounts manually, as they may not auto-calculate. Consult the ATO's Tax Withheld calculator if necessary.

- Calculate the net payment by taking the gross payment and subtracting the deductions. Document the employer’s superannuation contribution as needed, which should be calculated based on the super rate.

- After filling out all sections, review the information for accuracy. Once confirmed, you can save changes, download, print, or share the form as needed.

Complete your payslip online today to ensure accurate processing and management of your payments.

Related links form

Your payslips can be used as proof of your earnings, tax paid and any pension contributions. Employers can choose whether they provide printed or electronic (online) payslips. Payslips must be provided on or before payday.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.