Loading

Get Nevada Department Of Taxation Exempt Status Entity Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nevada Department Of Taxation Exempt Status Entity Form online

Filling out the Nevada Department of Taxation Exempt Status Entity Form online is a crucial step for entities seeking exemption from commerce tax requirements. This guide will provide you with a clear step-by-step approach to completing each section of the form accurately.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

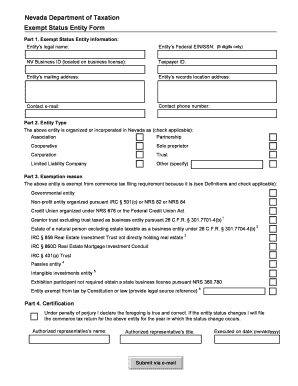

- In Part 1, enter the entity’s legal name exactly as it appears on official documents. Fill in the entity’s Federal EIN/SSN, ensuring it consists of 9 digits only. If applicable, provide the NV Business ID, taxpayer ID, and both the mailing address and records location address for the entity. Lastly, include the contact e-mail and phone number to facilitate communication.

- Move to Part 2 and check the appropriate box to indicate how the entity is organized or incorporated in Nevada. The options include association, partnership, cooperative, sole proprietor, corporation, trust, limited liability company, or other (provide specifics).

- In Part 3, specify the reason for the exemption from the commerce tax filing requirement. Review the listed definitions, then check the applicable boxes that best describe the entity's status, such as governmental entity, non-profit organization under specific sections of the IRC, or others as outlined.

- In Part 4, certify the accuracy of the information provided by entering the authorized representative’s name and title. Additionally, declare the execution date in the format mm/dd/yyyy.

- Once all sections are complete, save your changes to the document. You can choose to download, print, or share the completed form as needed.

Complete and submit your Nevada Department Of Taxation Exempt Status Entity Form online today.

Related links form

Exceptions to this are non-profit organizations, Indian Tribes, political subdivisions, and employers with household employees only.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.