Loading

Get Utility Sales Tax Exemption Application - State Forms Online Catalog - Forms In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Utility Sales Tax Exemption Application - State Forms Online Catalog - Forms In online

Filling out the Utility Sales Tax Exemption Application is an important step for users seeking exemption from sales taxes on utility purchases. This guide provides a clear and structured approach to completing the application form online, ensuring that users can navigate each section with confidence.

Follow the steps to successfully complete the application form online.

- Click ‘Get Form’ button to obtain the application and open it in the editor.

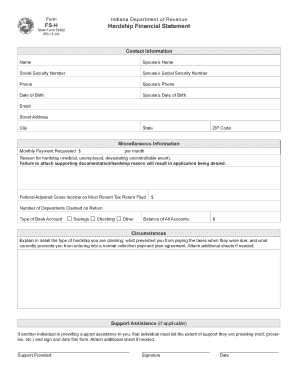

- Begin by entering your personal contact information, including your name, spouse's name, social security numbers, phone numbers, date of birth, and email address. Make sure this information is accurate to avoid any processing delays.

- Provide your street address, city, state, and ZIP code in the designated fields.

- Indicate the monthly payment amount you are requesting and provide a clear reason for your hardship, such as medical issues or unemployment. Remember that failing to provide supporting documentation will result in denial of your application.

- Fill in your federal adjusted gross income as stated on your most recent tax return filed, and enter the number of dependents claimed.

- Select the type of bank account you hold (savings, checking, or other) and input the total balance of all accounts.

- In the 'Circumstances' section, explain in detail your hardship circumstances, including reasons for being unable to pay taxes on time. If additional space is needed, attach extra sheets.

- If applicable, include information about any supportive assistance you are receiving from others, along with their signature and date of support.

- Document your monthly household income, listing all sources of income, including your net pay, spouse’s net pay, and other income types. Make sure to attach verification where required.

- Next, outline your monthly household expenses, providing details on rent/mortgage, utilities, and other expenses. Ensure you attach verification for these expenses as well.

- List your loan and credit card information, including the name of the financial institution, balance, and monthly payment for each.

- Review all entries made in the application to confirm their accuracy before proceeding.

- Complete the agreement section, making sure to provide your signature and the date, affirming the truthfulness of the information submitted.

- Once you've filled out the application and attached all necessary documentation, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your application online today to ensure timely processing!

Related links form

Indiana does not have standard deductions you can claim on your state income tax return. However, there are personal exemptions you can use to lower your tax liability. Single filers can claim $1,000, while married households can receive a $2,000 exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.